- October 25, 2025

- Personal Finance Advisor

- 0

You’re likely familiar with stocks and bonds. Perhaps real estate too. However, the world of alternative assets offers so much more. This guide will open your eyes. It is a fresh look at investing. Furthermore, it explores unique opportunities. You can grow your wealth in new ways. So, let’s dive into this exciting area. We will find hidden gems together.

What Exactly Are Alternative Assets?

Traditional investments are common. Think stocks, bonds, and cash. They are what most people know. Nevertheless, alternative assets are different. They fall outside these usual choices. Consequently, they offer unique traits. These may include low correlation to markets. This means they often move independently. Also, they can provide high returns. You might wonder what these are. They encompass many things. Some are tangible items. Others are less concrete. Therefore, understanding them is key. You can then diversify your holdings.

These assets often have special rules. They are not always liquid. Liquidity means how fast you can sell them. Public markets are very liquid. You can trade easily there. Conversely, alternatives might take time. They might need a special buyer. Furthermore, valuation can be tricky. There isn’t always a clear price. This makes them unique. Therefore, due diligence is a must. You must research carefully. They also often need more knowledge. This can be a barrier for some. Yet, the rewards can be great.

Why Consider Alternative Assets?

You might ask, “Why bother?” There are many good reasons. Primarily, they offer diversification. Most importantly, this reduces risk. If stocks fall, alternatives might not. They act as a buffer. Therefore, your total portfolio feels safer. This is a huge benefit. You spread your bets widely. Your money is not all in one place.

Furthermore, they can boost returns. Some alternative assets offer high gains. These gains can exceed typical market growth. This is very appealing. They also offer inflation protection. When prices rise, some assets hold value. Gold is a classic example. Real estate also can do this. Therefore, they guard your wealth. They keep your buying power strong. This is a smart move. You want your money to last.

Finally, they can be fun. Many people invest in passions. They enjoy collecting art. They love fine wine. Investing in these brings joy. It connects your money to hobbies. This makes wealth building more engaging. Therefore, it’s not just about money. It’s about personal interest too. This can make a big difference.

Tangible Treasures: Physical Alternative Assets

Now, let’s look at things you can touch. These are physical alternative assets. They have real-world value. Their worth is often clear. They can also be enjoyed. This makes them very special. Many collectors love these. They find joy in ownership. They also seek profit. Thus, it’s a win-win.

Fine Wine: A Drinkable Investment

You might love a good glass of wine. However, some wines are rare. They get better with age. Their value also goes up. Therefore, fine wine is an alternative asset. It is stored in special cellars. Proper conditions are vital. Collectors buy these wines young. They hold them for years. Then, they sell them for profit. This requires expert knowledge. You need to know good vintages. Also, you need to know brands.

Investing in wine is long-term. You won’t see quick gains. Moreover, it requires patience. You must store it well. This means paying for storage. So, factor in those costs. It is a liquid asset in some ways. You can sell at auctions. You can also use brokers. Furthermore, it offers a hedge. It is less tied to markets. However, the market for wine is niche. It’s not for everyone. You need a passion for it..

Art and Collectibles: Beauty and Bucks

Art can be stunning. It can also be a smart buy. Famous paintings, sculptures, and prints fall here. These are prime alternative assets. Their value can soar. This happens over time. Demand plays a huge role. The artist’s fame matters. Scarcity also drives price. A unique piece is worth more.

Beyond classic art, think collectibles. Old comic books gain value. Rare stamps are sought after. Vintage cars fetch high sums. Even sports cards can be huge. These are all alternative assets. They appeal to passions. Therefore, their markets are often strong. People want what is rare. They want what they love. This creates high demand. You need expert knowledge here. Knowing authenticity is key. Provenance also matters. This is the item’s history. It proves it is real.

Buying art or collectibles needs care. You must know the market. You must spot fakes. Authentication is very important. Therefore, use trusted dealers. Go to known auction houses. Storage can also be a cost. You might need insurance. These items can be fragile. They need careful handling. However, the joy of owning them is great. The potential for profit is also high.

Precious Metals: Gold, Silver, and Beyond

Gold is a classic safe haven. You probably know this. It is a top alternative asset. When markets fall, gold often rises. It holds value well. This is due to its history. People trust it as money. Silver is also a good choice. It has industrial uses. Therefore, its demand is strong. Both metals are tangible. You can hold them in your hand. This brings a sense of security.

You can buy physical gold. This means coins or bars. You can also buy ETFs. These track gold prices. They are easier to trade. They do not need storage. However, they are not physical. Most importantly, research your options. Buying physical metal needs care. You must ensure purity. You need secure storage. This often means a vault. You also pay for this service. These costs add up.

Diversifying with metals is smart. They protect against inflation. They hedge against crisis. Therefore, they play a vital role. They are not high-growth assets. Instead, they preserve wealth. They are a good buffer. Your portfolio needs stability. Metals provide just that. They are a bedrock asset.

Digital & Modern Alternative Assets

The world changes fast. So do investments. New alternative assets are digital. They exist online. They are modern options. These offer different risks. They also offer new rewards. You need to learn about them. They are part of the future. You can’t ignore them. They are growing fast.

Cryptocurrencies: The Digital Gold Rush

Bitcoin started it all. It is a digital currency. It uses cryptography for safety. Now, there are thousands. Ethereum, Solana, and more exist. They are all alternative assets. They are volatile, meaning prices swing. This creates huge chances for profit. It also carries big risks. You can lose money fast. Therefore, know your risk tolerance. Do not invest more than you can lose.

Cryptocurrencies are decentralized. No single bank controls them. This appeals to many. They offer privacy too. They are traded on exchanges. You need a digital wallet. Security is very important here. You must protect your keys. Losing them means losing coins. Furthermore, regulation is evolving. Rules change often. This adds to the risk. However, the tech is amazing. It has many uses beyond money. This draws in investors.

The future of crypto is bright. It is also uncertain. It offers a new way to invest. It can be a small part. It can also be a large one. You must do your homework. Understand the tech. Understand the risks. Then decide your path. This is a brave new world.

Non-Fungible Tokens (NFTs): Unique Digital Ownership

You might have heard of NFTs. They are unique digital items. They use blockchain tech. This proves ownership. An NFT can be art. It can be music. It can be a tweet. It can even be land. Virtual land, that is. They are new alternative assets. Their value comes from scarcity. It also comes from hype. People pay a lot for them. This is often based on trends.

NFTs are often tied to crypto. You buy them with crypto. They live on a blockchain. This ledger is public. It shows who owns what. However, the market is young. It is highly speculative. Prices can crash fast. Therefore, invest with caution. Understand the project first. Look for real utility. Does it offer true value? Or is it just a fad?

They offer new ways for artists. Artists can sell work directly. Collectors can own unique pieces. This is exciting for creators. It also offers new community. Many NFTs have strong communities. This adds to their appeal. However, the long-term value is unknown. It is a new space. Therefore, be careful. Learn the basics first.

Digital Real Estate & Metaverse Assets: Virtual Worlds, Real Value

The metaverse is growing. It is a virtual world. You can buy digital land there. You can build virtual homes. You can also host events. These are called metaverse assets. They are a form of alternative asset. Their value comes from demand. People want to be in these spaces. Companies want to advertise. Therefore, land can be pricey.

Investing in digital real estate is new. It is similar to physical land. Location still matters. Scarcity also drives value. However, it’s all virtual. It relies on the platform’s success. If the platform fails, so does your asset. So, choose wisely. Invest in popular platforms. Understand their future plans. This is crucial for growth.

These assets can generate income. You can rent out land. You can sell virtual items. You can host events for a fee. This is very appealing. However, it is also risky. The market is very new. It could boom or bust. You need to be aware. This is a frontier investment. It needs bold thinking. It needs deep research.

Real Estate: Beyond the Brick and Mortar

You probably know real estate. Buying a home is common. It is a basic asset. However, there are other ways. These are also alternative assets. They offer new paths. They can boost your income. They can grow your wealth. They also have different risks. You should explore them.

Crowdfunded Real Estate: Investing Without Direct Ownership

You can invest in property. You don’t need to buy a whole building. Crowdfunding lets you pool money. Many investors join forces. They buy a large property. This could be an apartment complex. It could be a commercial building. You own a small share. This is a clever way. It makes real estate accessible. It lowers your entry cost. Therefore, it’s less risky.

These platforms manage everything. They handle the buying. They handle the tenants. They send you your share. This includes rent income. It also includes profits. This is a passive approach. You don’t do the work. You simply invest. Therefore, it’s good for busy people. It is a simple way to diversify. You get real estate exposure. You avoid landlord duties.

However, research the platform. Check their track record. Look at their fees. Understand the risks. Your money is tied up. It might not be liquid. The property might lose value. So, pick carefully. This is a growing field. It offers good potential. It is also an easier entry.

Timberland & Farmland: The Green Alternative Assets

Trees grow. Crops grow. These are unique alternative assets. Timberland means investing in forests. You buy land with trees. As trees grow, their value rises. You can sell timber later. Farmland means buying agricultural land. You can lease it to farmers. You earn rental income. Or, you can farm it yourself. This is more active.

These assets offer stability. They are less tied to markets. Food and wood are always needed. Therefore, demand is constant. They also hedge inflation. Land often increases in value. This protects your buying power. Furthermore, they are tangible. You can see your investment. This is reassuring for some.

However, they are not liquid. Selling large tracts takes time. You need deep knowledge. Understanding forestry is key. Knowing farming trends matters. Management costs are real. They include taxes and upkeep. So, factor these in. These are long-term plays. They offer steady growth. They offer income too. They are truly green investments.

Unique Alternative Assets & Future Trends

The world of alternative assets is vast. It’s always expanding. New ideas pop up all the time. Staying current is important. You want to spot trends early. This can lead to big wins. These next few items are quite niche. They show how diverse this field is. They might spark new ideas for you.

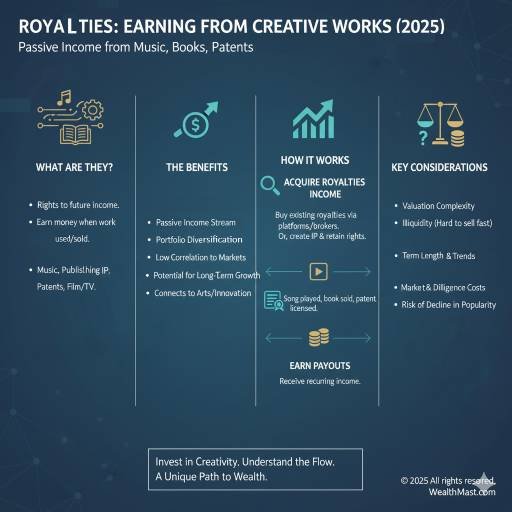

Royalties: Earning from Creative Works

You can buy royalties. These are rights to future income. They come from creative works. Think music. Think books. Think patents. When a song plays, you get paid. When a book sells, you get paid. These are alternative assets. They offer passive income. Once you own them, money flows. This is very appealing. It is a long-term income stream.

Buying royalties needs research. You need to know the work’s history. Is it popular? Will it stay popular? Therefore, look at trends. Understand the terms. How long do rights last? Are there any hidden fees? You also need to value them. This can be complex. You project future earnings. Then you set a price.

Platforms exist for this. They help you buy and sell. They make it easier. However, it’s still niche. It is not for everyone. But it offers a cool path. It connects you to art. It makes money from it. It’s a true passive income.

Collectible Cars: Driving Towards Wealth

Some cars are not just transport. They are works of art. They are rare machines. Classic cars, vintage models, and supercars. They are all alternative assets. Their value can skyrocket. This depends on many factors. Rarity is key. Condition is vital. History and provenance also matter. A race-winning car is worth more.

Investing in cars is a passion. You must love cars. You must know cars. Maintenance is also a huge cost. These cars need special care. They need climate control. They need expert repairs. Therefore, consider these costs. They can eat into profit. Insurance is also a factor. Protecting your asset is crucial.

However, the upside is real. Many cars have seen huge gains. They also provide joy. You can drive them. You can show them off. This makes them unique. It blends hobby with investing. This is a very cool option. It is for true enthusiasts.

Luxury Goods: Designer Bags to Rare Watches

Fashion can be an investment. High-end designer bags. Rare luxury watches. These are alternative assets. Their value can increase. This happens over time. Brands like Hermes, Chanel, Rolex. They hold their worth. Some pieces even gain value. They are seen as scarce. They are seen as status symbols.

Investing here needs knowledge. You must know the brands. You must know the models. Authentication is key. Fakes are common. Therefore, buy from trusted sources. Condition also matters. A pristine bag sells for more. A watch with its box and papers is better. These details boost value.

They offer a unique blend. You can enjoy them. You can use them. They also act as wealth storage. They are less tied to markets. They are a way to diversify. This is for the fashion-savvy. It’s for those with an eye for quality. It shows how broad “assets” can be.

Risks and Rewards of Alternative Assets

You’ve seen many options. Each has its own appeal. However, all investments have risks. Alternative assets are no exception. In fact, some have higher risks. You need to be aware. Knowledge is your best friend. Understanding helps you mitigate risk. Therefore, never invest blindly.

The Upside: Potential for High Returns & Diversification

The rewards can be huge. Many alternatives offer high returns. They can outperform traditional markets. This is very attractive. They also offer true diversification. They don’t always move with stocks. This smooths out your portfolio. It reduces overall risk. Therefore, they make your wealth more stable. This is a powerful benefit.

They offer tangible enjoyment. You can own art. You can wear a watch. You can drive a classic car. This adds another layer. It connects to your passions. This is very different. Stocks don’t offer this. This makes investing more fun. It is more engaging. Thus, it keeps you interested.

The Downside: Liquidity, Valuation, and Expertise

However, there are downsides. Liquidity is a big one. Selling alternative assets takes time. You might not find a buyer fast. This means your money is tied up. It is not easy cash. Valuation is also tricky. There’s no clear market price. Experts value these items. Their opinions can differ. This adds to the uncertainty.

Expertise is a must. You need to know the field. Without knowledge, you might lose. Fakes are common in some areas. Scams are also present. Therefore, you must learn a lot. This takes time and effort. It is not passive learning. You also need secure storage. This can cost money. Insurance is also needed. These extra costs reduce profit.

Regulation is often less clear. Traditional markets have many rules. Alternative assets might not. This can lead to issues. It can mean less protection. Therefore, tread carefully. Understand the landscape. Protect your money well.

How to Get Started with Alternative Assets

You are now keen to explore. This is a good sign. But where do you begin? Starting with alternative assets needs a plan. You need to be strategic. You need to be careful. Do not jump in head first. Start small and learn. That is the best approach.

Education is Your Best Alternative Asset

First, learn, learn, learn. Read books. Read articles. Listen to podcasts. Watch videos. Become an expert in one area. Do not try to learn all. Pick a niche that excites you. This could be wine. It could be NFTs. Knowledge lowers your risk. It helps you spot value. Therefore, make learning your priority. This is the first step.

Start Small and Diversify Gradually

Do not put all your eggs. Begin with a small amount. Test the waters. See how it goes. You can then add more. Spread your investments. Do not put everything in one art piece. Diversify within alternative assets. This further lowers risk. It protects your capital. Therefore, be patient and spread out.

Find Reputable Platforms and Experts

When you buy, use trusted sources. For wine, use known merchants. For art, use famous galleries. For crypto, use secure exchanges. This is vital for safety. They verify authenticity. They offer protection. Therefore, do your homework on sellers. A good expert is worth gold. They guide your choices. They save you from mistakes.

Understand the Tax Implications

Alternative assets have tax rules. These can be complex. Gains might be taxed differently. This depends on your location. It also depends on the asset type. Therefore, consult a tax advisor. Understand your tax burden. Plan for it in advance. This avoids nasty surprises.

Be Patient and Play the Long Game

Most alternatives are long-term. They need time to grow. Do not expect quick riches. This is not a get-rich-quick scheme. Patience is a virtue here. The market for them is slower. Holding for years often pays off. Therefore, adopt a long-term view. Your wealth will grow steadily.

Final Thoughts on Alternative Assets

You have now seen a new world. The realm of alternative assets is vast. It offers unique opportunities. It offers new challenges. It can boost your wealth. It can diversify your portfolio. Most importantly, it can be engaging. You can invest in your passions. This makes investing more fun.

Remember the key points. Diversify your holdings. Learn your chosen niche well. Understand the risks involved. Be patient with your investments. Avoid rushing into things. The world of money is huge. There are many paths to wealth. Alternative assets are one such path. They can be a powerful tool. Use them wisely and grow rich.