- July 12, 2024

- August Prosper

- 0

Hey there, fellow crypto enthusiasts and worried investors!

Is your heart doing backflips every time you check the Bitcoin price? Are you wondering if you should cut your losses or hold on for dear life? Don’t worry, you’re not alone in this crypto rollercoaster.

Today, we’re diving deep into the wild world of Bitcoin crashes. We’ll explore why they happen, what they mean, and most importantly – what you should do when your crypto investment looks like it’s going down faster than a lead balloon.

The Bitcoin Panic: What’s Really Going On?

So, Bitcoin’s price is taking a nosedive, and everyone’s losing their minds. What’s the deal?

First things first: Crypto markets are volatile. And when I say volatile, I mean more unpredictable than a cat on catnip.

One day you’re on top of the world, planning your Lambo purchase, and the next, it feels like the crypto gods have forsaken us all.

But before you start panic-selling or considering a new career as a hermit, let’s take a deep breath and look at what’s really happening.

Why is Bitcoin Crashing?

There could be several reasons why Bitcoin’s price is heading south. Let’s break them down:

- Market Correction

Sometimes, Bitcoin’s price goes up too fast, too soon. When this happens, a crash can be the market’s way of saying, “Whoa there, buddy, let’s slow down a bit.” It’s like when you eat too much pizza – eventually, you’ve got to stop and digest.

- Regulatory News

Governments and their pesky regulations can have a big impact on Bitcoin’s price. When China says “no more mining” or the US talks about new crypto taxes, investors get spooked.

- Big Players Making Moves

In the crypto world, we call them “whales” – investors with big enough holdings to make waves when they buy or sell. When a whale dumps a ton of Bitcoin, it can trigger a selling frenzy.

- Global Economic Factors

Surprise, surprise – the real world affects crypto too! Economic downturns, inflation fears, or even a global pandemic can send Bitcoin’s price tumbling.

- Technical Issues

Sometimes, it’s not about economics or psychology – it’s about tech. Network congestion, exchange hacks, or fears about Bitcoin’s scalability can all contribute to a price crash.

- Media Influence

Never underestimate the power of FUD (Fear, Uncertainty, and Doubt) spread by media. One negative headline can sometimes spark a selling spree.

The Million-Dollar Question: Should I Stay or Should I Go?

Now for the big question that’s probably keeping you up at night: Do you hodl (hold on for dear life) or cut your losses?

Here’s my take, broken down into bite-sized pieces:

- Don’t Panic Sell

I know it’s tempting. Your portfolio’s in the red, and you want to stop the bleeding. But here’s the thing: Panic selling is how you turn a temporary loss into a permanent one. It’s like trying to catch a falling knife – dangerous and likely to end in tears.

- Remember Why You Invested

Cast your mind back to when you first bought Bitcoin. What was your reason? Did you believe in its long-term potential? Its ability to revolutionize finance? Or were you just trying to make a quick buck?

If your original reasons for investing still hold true, then a price crash doesn’t change the fundamental value proposition of Bitcoin.

- Consider Your Financial Situation

Be honest with yourself. Can you afford to wait out this storm? If you invested your life savings or took out loans to buy Bitcoin (which, by the way, is a terrible idea), then you might need to reconsider your position.

- Look at the Big Picture

Zoom out on that price chart. Like, way out. Bitcoin’s had plenty of crashes before, and it’s always bounced back… so far. Past performance doesn’t guarantee future results, but it’s something to keep in mind.

- Assess Your Risk Tolerance

How much volatility can you stomach? If Bitcoin’s wild price swings are giving you more grey hairs than your teenage years, it might be time to reevaluate your crypto holdings.

The Case for Staying Invested

Alright, let’s talk about why you might want to keep your Bitcoin, even when it feels like it’s all going to hell in a handbasket.

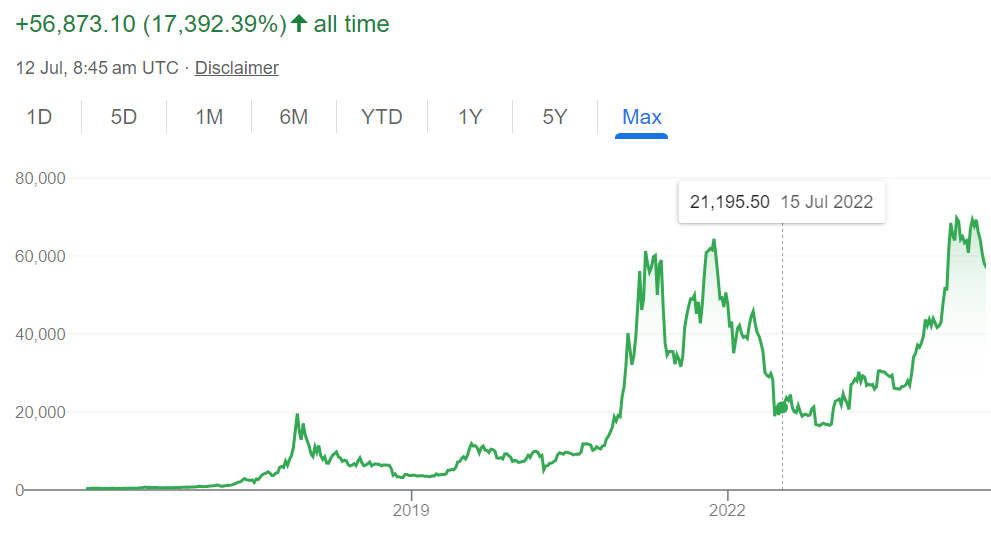

1. Historical Performance

Bitcoin’s been through some rough patches before.

Remember the crash of 2017? Or the COVID-induced meltdown of 2020? Each time, Bitcoin not only recovered but went on to reach new all-time highs.

Here’s a quick history lesson:

– 2017: Fell to $3,000

– 2020: Crashed from $10,000 to $6,000

– 2021: Crashed from $61,000 to $31,000

– 2022: Crashed from $45,000 to $16,000

– 2024 at time of writing this article: Came down from $71,000 to $57,000

And yet, here we are, still talking about Bitcoin. It’s like the Terminator of the financial world – it just keeps coming back.

2. Limited Supply

This is Economics 101, folks. Bitcoin has a fixed supply – there will only ever be 21 million Bitcoin. As demand increases (assuming it does), and supply remains limited, basic economic theory suggests the price should go up in the long run.

It’s like digital gold, but instead of having to dig it up from the ground, it’s mined by computers solving complex math problems. Neat, huh?

3. Increasing Adoption

More and more companies, institutions, and even countries are getting on board the Bitcoin train.

- El Salvador made Bitcoin legal tender

- Major companies like Tesla and MicroStrategy have added Bitcoin to their balance sheets

- PayPal and Square now allow users to buy and sell Bitcoin

This increasing adoption could drive demand (and potentially price) in the long term.

4. Potential as a Hedge

Some folks see Bitcoin as a hedge against inflation and economic uncertainty. In a world where governments are printing money like there’s no tomorrow, Bitcoin’s fixed supply is looking pretty attractive to some investors.

It’s like a digital version of stuffing cash under your mattress, except it has the potential to grow in value (and it takes up less space).

The Case for Selling

Alright, I promised you a balanced view, so let’s look at the flip side. Here’s why you might consider selling your Bitcoin:

1. You Need the Money

Life happens. Maybe you’ve lost your job, have unexpected medical bills, or need to put a down payment on a house. If you need the money, it’s okay to sell. Your wellbeing comes first.

2. You’ve Lost Faith in Bitcoin

Maybe you’ve done more research and decided that Bitcoin isn’t the future of finance after all. Or perhaps you think another cryptocurrency has more potential. It’s okay to change your mind based on new information.

3. You’ve Found Better Opportunities

The crypto world moves fast. Maybe you’ve spotted another investment opportunity that you think has more potential. It’s okay to pivot your strategy.

4. The Stress is Too Much

If checking Bitcoin prices is giving you more anxiety than your high school exams, it might be time to reevaluate. Money is important, but so is your mental health.

5. You Don’t Understand What You’ve Invested In

If you bought Bitcoin because your neighbor’s dog walker’s cousin said it was going “to the moon,” but you don’t really understand how it works, it might be time to step back and reassess.

Tips for Weathering the Storm

If you’ve decided to stay invested, here are some tips to help you get through this rough patch without losing your sanity:

- Don’t Obsess Over Prices

Checking the Bitcoin price every five minutes will drive you nuts. Set price alerts if you must, but try to avoid constantly refreshing that chart.

- Diversify

Don’t put all your eggs in the Bitcoin basket. Consider diversifying your investments across different asset classes. Maybe some stocks, some bonds, some real estate, and yes, some crypto.

- Keep Learning

The more you understand about Bitcoin and blockchain technology, the better equipped you’ll be to make informed decisions. Read books, follow reputable crypto news sources, join online communities.

- Set Some Stop-Losses

Decide in advance at what point you’ll sell to limit potential losses. This can help take emotion out of the equation.

- Consider Dollar-Cost Averaging

Instead of trying to time the market, consider buying a fixed amount of Bitcoin at regular intervals. This strategy can help smooth out the impact of volatility over time.

- Secure Your Bitcoin

If you’re in it for the long haul, make sure your Bitcoin is secure. Use hardware wallets, enable two-factor authentication, and for heaven’s sake, don’t lose your private keys!

- Take Care of Yourself

Crypto investing can be stressful. Make sure you’re taking care of your physical and mental health. Exercise, eat well, get enough sleep, and maybe try some meditation (I hear it works wonders for crypto anxiety).

My Personal Take

Look, I’m just a fellow Bitcoin enthusiast who’s been through a few of these rodeos.

Here’s what I personally do when Bitcoin crashes:

- I take a deep breath. Seriously, breathe. It helps.

- I remind myself why I invested in Bitcoin in the first place. For me, it’s about the long-term potential of the technology.

- I look at my overall financial picture. Is this money I can afford to lose? If yes, I’m more likely to hold on.

- If I can afford to, I hold on tight. I’ve been through crashes before, and I know that patience often pays off.

- Sometimes, I even buy more. But only if I can afford to lose that money. Remember, never invest more than you can afford to lose!

- I try to learn from the experience. Each crash teaches me something new about the market, about Bitcoin, and about my own risk tolerance.

Frequently Asked Questions

Q: Is this the end of Bitcoin?

A: Unlikely. Bitcoin’s been declared “dead” hundreds of times by various media outlets and critics. It’s still kicking. That said, there are no guarantees in the world of crypto.

Q: Should I buy more while the price is low?

A: This is a personal decision that depends on your financial situation and risk tolerance. Some investors see price dips as buying opportunities, but remember – only invest what you can afford to lose.

Q: How long will this crash last?

A: If I knew that, I’d be writing this from my private island. The truth is, nobody knows for sure. Crypto markets are unpredictable.

Q: Will Bitcoin ever reach its all-time high again?

A: It’s possible, but not guaranteed. Bitcoin has a history of reaching new highs after crashes, but past performance doesn’t guarantee future results.

Q: Is it too late to get into Bitcoin?

A: That depends on your perspective and risk tolerance. Some people believe Bitcoin is just getting started, while others think it’s a bubble. Do your own research before jumping in.

Q: What if Bitcoin goes to zero?

A: While it’s technically possible, it’s unlikely given Bitcoin’s decentralized nature and global adoption. However, it’s a risk you should be prepared for if you’re investing in crypto.

Q: How do I know when to buy or sell?

A: Timing the market perfectly is nearly impossible. Many investors use strategies like dollar-cost averaging to mitigate the impact of market volatility.

The Bottom Line

Bitcoin crashing can be scary, especially if you’re new to the crypto world. But whether you stay invested or cash out depends on your personal situation, risk tolerance, and belief in Bitcoin’s future.

Remember, investing in Bitcoin is not a get-rich-quick scheme. It’s a volatile, high-risk asset that requires careful consideration and a strong stomach.

Whatever you decide, make sure it’s a decision you can live with. Don’t let FOMO (Fear of Missing Out) or FUD (Fear, Uncertainty, and Doubt) cloud your judgment.

And remember, in the wild world of crypto, the only constant is change. So buckle up, do your research, and enjoy the ride!

P.S. Don’t forget, I’m just a random person on the internet sharing my thoughts and experiences. Always do your own research and consider seeking advice from a financial professional before making big investment decisions.